Why Banks Are Using Blockchain Technology

Posted by Admin on February 02, 2017By Kunal Nandwani,

Founder and CEO, uTrade Solutions

|

The Bitcoin concept was introduced in 2008, for one major reason: to get away from a centralized system where financial institutions, state and regulators were not trusted.The first white paper on Bitcoin appeared in November 2008, after Lehman Brothers went bankrupt in September, and several other financial institutions failed to honor their commitments.

Bitcoin has been a major disruption of the 21st century. Who could have imagined in 2009 that people would be giving away real, hard-earned money ($900 for 1 digital coin), to get a digital currency which nobody owns, no central bank guarantees, is not backed by gold or any other asset, is not even accepted for most real-world products and services, and can be lost if you lose your digital access?

Fun fact: a programmer used 10,000 BTC for two Papa John’s pizzas in 2010. Back then the technology was just over a year old, and it equaled roughly $25, but at today’s Bitcoin exchange rate, it is over $9 million.

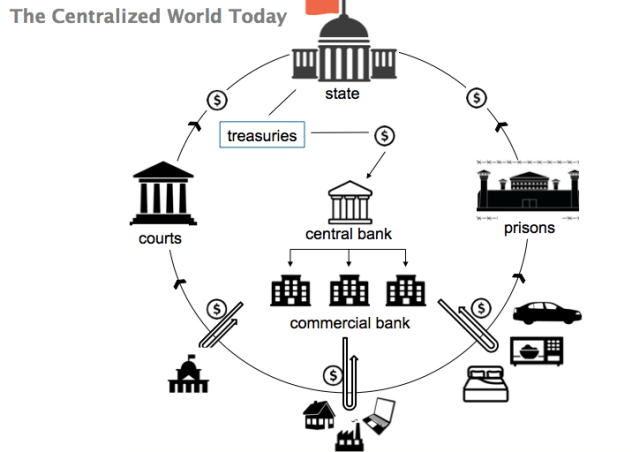

Before Bitcoin, the financial currency world looked like this, with regulators, government, financial institutions, and a legal system enabling a stable currency:

|

With Blockchain, that system became decentralized, self-regulating, immutable, borderless and digital.

What is Blockchain?

Bitcoin is driven by a technology called Blockchain, which helps build trust among people while creating and transferring unique value, without a central institution or regulator. Blockchain transactions are transparent and immutable. Blockchain has the potential to become Internet 2.0, with no company like Google or Facebook owning and selling user data. With user privacy being increasingly understood and valued, Blockchain may offer interesting alternatives to various internet platforms.

Blockchain relies on cryptography-driven mining, to build trust using a collaborative, transparent technology process. Bitcoin mining is a computing-intensive process: 300,000 transactions daily need more than 10 times the computing power of Google (3.5 billion searches daily).

Blockchain promises lot of value for auditable, immutable transaction platforms for assets including money (Bitcoin), user information (Know Your Customer, or KYC, platforms), assets registry (property), issuing digital documents (certificates), finance, and so on.

If Blockchain Decentralizes, Why Do Banks Like It?

Blockchains are meant to decentralize, so with applications such as Bitcoin, they undermine the need for the bank or any central financial institution. So when banks are keen on Blockchain, isn’t it like Walmart in 2000, trying to become Amazon?

Most banks worldwide are trying to be involved in Blockchain for a couple of reasons. One is that they want to learn about Blockchain, and the best way is to implement it in some use case, such as transactions, finance, or KYC. These use cases are less likely to go forward into full implementation. Blockchain’s nature of immutable digital information sharing is seen as valuable for several banks’ legacy processes.

Banks are forming consortiums to run proprietary (in due course, open source) Blockchain platforms, to transact better with each other. Legacy back-office infrastructure is expensive and slow.

Banks do not need to decentralize or build trust to transact with each other, so Blockchain’s core value is not fully utilized. The same functions can be achieved by shared database technologies, too, which are more mature, cheaper and easier to implement. However, adopting Blockchain lets banks collaboratively improve post-transaction infrastructure, by overcoming the organizational challenges towards change.

In such scenarios, banks will use Blockchains which can only be used by approved institutions, and not by the public. This keeps the Blockchain platform relatively safer than public Blockchains like Bitcoin, where anyone can join the network, mine it, and even record transactions.

Moreover, engagement with the latest technology makes for good PR. Hence the race for the first new use-case.

A note of caution: some banks have (wrongly) sought to patent their Blockchain use cases. Some of these use cases are so basic and unimaginative that there is no innovation to protect. It’s also worth noting that banks are unlikely to run public Blockchain platforms. In the case private Blockchains, it should not matter whether the workflow or technology is patented or not. It’s unlikely that a bank will make money by selling a patented permissioned Blockchain.

In fact, the more open the technology, the more likely it is to have greater usage and become more stable. Linux versus Windows is a classic example.

The original version of this article appeared here in December 2016. Adapted and used here with permission.